Highlight of the week: SSV is up >35% on the week & ![]() ETH ETF, ETH ETF, ETH ETF

ETH ETF, ETH ETF, ETH ETF ![]()

The big news today is that the SEC is set to make a decision ![]() … (to approve) on the spot Ethereum ETF. ETH has been surging in the last few hours.

… (to approve) on the spot Ethereum ETF. ETH has been surging in the last few hours.

- After last weeks loses, SSV has started to make a great recovery.

- SSV is >35% up on the week

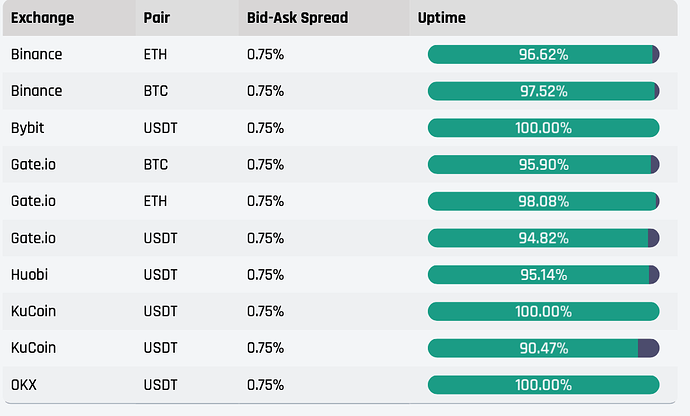

A few notes to explain what you are seeing:

• “7d Avg Spread” is the average spread from the best performing spread market (Binance USDT pair).

• “4% Liquidity” is ±2% from midprice liquidity sitting in the books across all exchanges

• In the individual pairs, the “2% Liquidity” is ±1% from the midprice liquidity sitting in that individual pair

*The price movement and comparison can be referenced on CoinGecko under “How does the price performance of SSV Network compare against its peers?” SSV Network Price: SSV Live Price Chart, Market Cap & News Today | CoinGecko

- Volumes have not picked up

- As the hype surrounds ETH, we suspect volumes to improve as the week progresses. Check in for next weeks review to see if this comes to fruition

- We are reviewing our strategy to provide more attention to primary venues

Liquidity Snapshots

- Below is the average liquidity for the week. 2% = ±1%, 4% = ±2%, 8% = ±4%

Spreads for the previous week.

- This is the % of time EF kept spreads from bid-ask at 75bps or better.

Please follow market spreads either on the exchanges or Coingecko/Coinmarket cap to validate that our spreads are remaining below the agreed upon KPI

This does not include liquidity & trading in the V3 pool

Our aim is to continue to incentive volume and sustained trading health in the SSV market while remaining as transparent as we can with community members