Highlight of the week: ETH products outperforming the down turn in the market. Efficient Frontier traded ~$10.525m worth of SSV in the last week. We continue to provided support at key levels.

The last two weeks have seen large corrections, except for ETH-related projects.

There’s been a decent recovery in the last 24 hours with a 9.91% increase in traded volume. The market has been heavily apeing into meme coins, and $875 million worth of tokens are set to be unlocked this month. Additionally, Mt. Gox will start redistributing Bitcoin and Bitcoin Cash next month, all could lead to further volatility.

- SSV is up ~1.5% in the last week (At UTC 00:00)

- SSV at 15:00 UTC is up 7.8% in the last week.

A few notes to explain what you are seeing:

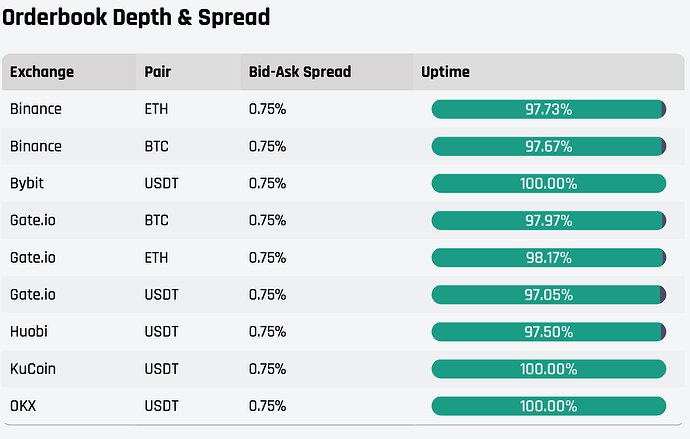

• “7d Avg Spread” is the average spread from the best performing spread market (Binance USDT pair).

• “4% Liquidity” is ±2% from midprice liquidity sitting in the books across all exchanges

• In the individual pairs, the “2% Liquidity” is ±1% from the midprice liquidity sitting in that individual pair

*The price movement and comparison can be referenced on CoinGecko under “How does the price performance of SSV Network compare against its peers?” SSV Network Price: SSV Live Price Chart, Market Cap & News Today | CoinGecko

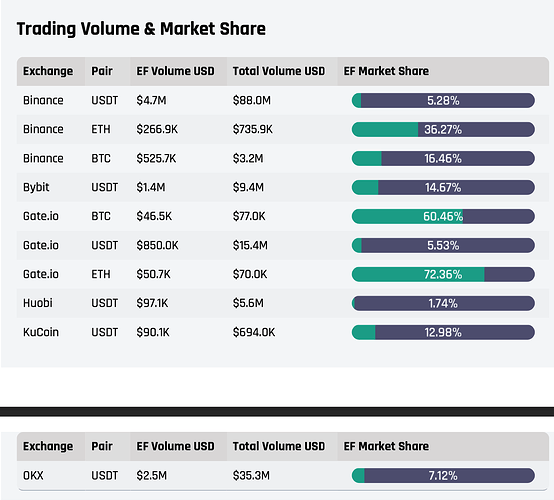

- EF traded $10.524m worth of SSV

- We’re >5% of the market share on Binance and >7% on OKX - We’re keeping true to our promise to ramping up our activity in the SSV market.

Liquidity Snapshots

- Below is the average liquidity for the week. 2% = ±1%, 4% = ±2%, 8% = ±4%

Spreads for the previous week.

- This is the % of time EF kept spreads from bid-ask at 75bps or better.

This does not include liquidity & trading in the V3 pool

Our aim is to continue to incentive volume and sustained trading health in the SSV market while remaining as transparent as we can with community members