SSV community, find below the market-maker performance update.

A rollercoaster in the market this week! Hope all of you had little-to-no exposure to Silvergate, SVB or Signature. Definitely a blow to the crypto industry to have the 3 largest crypto-friendly US banks collapse. But also, a good sign to have less trust in traditional banking and more trust in crypto. Great signal that USDC regained it’s peg.

SSV more or less ended the week where it started. It was an incredibly volatile week throughout, capped off by the bailout news and great little pump after the positive CPI announcement

A few notes to explain what you are seeing:

• “7d Avg Spread” is the average spread from the best performing spread market (Binance USDT pair).

• “4% Liquidity” is ±2% from midprice liquidity sitting in the books across all exchanges

• In the individual pairs, the “2% Liquidity” is ±1% from the midprice liquidity sitting in that individual pair

Marketshare for the previous week:

Spreads for the previous week.

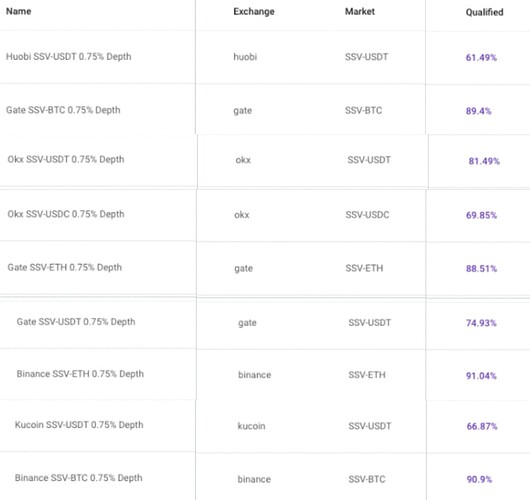

This is the % of time EF kept spreads from bid-ask at 75bps or better.

This does not include the hedging activity on BUSD on Binance and the liquidity & trading in the V3 pool.

Our aim is to continue to incentive volume and sustained trading health in the SSV market