SSV community, find below the market-maker performance update.

The crypto markets (and SSV) came back down to earth a little bit this week. The Silvergate FUD led to huge crypto liquidations and a flash crash across the market late last week. That said, SSV still outperformed your main competitors as seen below. The OKX listing was a great success and has quickly become the 2nd most important market behind Binance.

A few notes to explain what you are seeing:

• “7d Avg Spread” is the average spread from the best performing spread market (Binance USDT pair).

• “4% Liquidity” is ±2% from midprice liquidity sitting in the books across all exchanges

• In the individual pairs, the “2% Liquidity” is ±1% from the midprice liquidity sitting in that individual pair

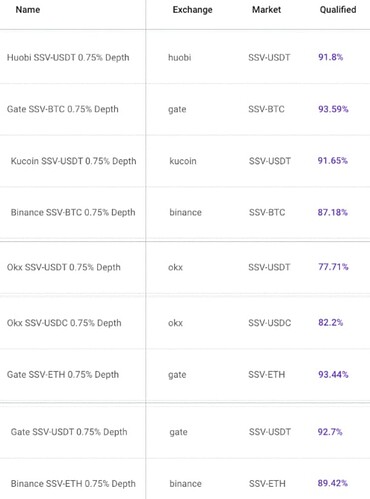

Marketshare for the previous week:

Spreads for the previous week.

This is the % of time EF kept spreads from bid-ask at 75bps or better.

This does not include the hedging activity on BUSD on Binance and the liquidity & trading in the V3 pool.

Our aim is to continue to incentive volume and sustained trading health in the SSV markets.