Summary

This proposal aims to continue the adoption of DVT and the use of ssv.network by the Ethereum ecosystem at large by prolonging the existing Incentivized Mainnet Program (hereinafter: “IMP”) until December 31st 2027 and adding additional budget for its pool of rewards for up to 300.000 validators or 9.600.000 ETH.

Motivation

Since the introduction of the previous IMP revision, the ssv.network has experienced unprecedented growth. As a consequence of the IMP program, in 1 year since the launch of permissionless Mainnet (December 22nd, 2023) and the IMP (November 6th 2023), the ssv.network was trusted by approximately 50.000 validators. Four months before the expiry of the second year of permissionless mainnet, the ssv.network was trusted by more than 130.000 validators. This effectively means that the network grew by more than 160% in less than a year, leading it to be the second largest infra staking provider, behind only Lido, with recognition from the biggest players in the industry such as, Lido, Kraken, P2P.org, Kiln, etc.

This stellar growth is thanks to a very strong product of the ssv.network DAO (hereinafter: “DAO”), its community and the incentives the DAO allocates for the adoption of DVT and the protocol. This has led the DAO to rake in a potential 300.000+ SSV annually, which currently means that the DAO can effectively earn 3.000.000 USD annually, and potentially 9.600.000 USD annually if the price of SSV is closer to its average for 2024, which effectively means that the DAO is covering more than 60% of its annual cost less than two years into its mainnet launch.

With this in mind, it’s of crucial importance to continue the IMP until the new bold DAO vision of SSV 2.0, based sequencer, synchronous composability, rollup centrism and ETH alignment provides for a sustainable way of retaining the existing user base and expanding it further, as a continuous source of the lifeblood to the network.

Therefore, due to the fact that the IMP rewards budget will be depleted for the August distribution, it is of vital importance to provide the IMP with a new budget and an extended validity past the currently slated end of the program on the 31st of December 2025.

With this in mind, the proposal suggests that a % of the total supply be allocated as the pool of rewards, while the program’s validity be extended to December 31st, 2027. At the current rate of the monthly distribution of approximately 150.000 SSV, the newly proposed % of total supply mitigates the effects on the SSV tokenomics. Therefore, the proposed amount and end date take into consideration a potential slump in the growth of the network and the adjustment of prospective users as they slowly transition to SSV 2.0.

Mechanics

Refactored Reward Tiers

The program tiers and corresponding APR boosts as set out in DIP-34, will be replaced by the following new tiered rewards system:

| Validators (approx.) | Effective Balance (ETH) Tier | APR Boost |

|---|---|---|

| 100,001 - 125,000 | 3,200,032 – 4,000,000 | 7.50% |

| 125,001 - 150,000 | 4,000,032 – 4,800,000 | 6.00% |

| 150,001 - 175,000 | 4,800,032 – 5,600,000 | 5.00% |

| 175,001 - 200,000 | 5,600,032 – 6,400,000 | 4.25% |

| 200,001 - 225,000 | 6,400,032 – 7,200,000 | 3.50% |

| 225,001 - 250,000 | 7,200,032 – 8,000,000 | 3.00% |

| 250,001 - 300,000 | 8,000,032 – 9,600,000 | 2.50% |

(Note: Post-Pectra upgrade and DIP-34, tiers are calculated by effective balance in the protocol, making validator counts approximate and only indicative.)

Inflation Cap

The incentive program will be capped by a 15% annual inflation limit:

- Each year at 00:00 UTC on January 1st, the total supply of $SSV will be recorded.

- A maximum of 15% of that supply may be allocated to IMP rewards for that year.

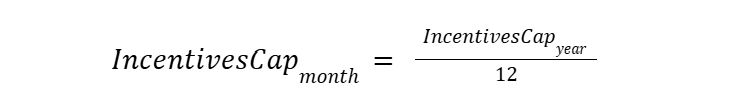

- This annual cap will be split evenly across the 12 monthly distribution rounds:

Example:

If the total supply on Jan 1, 2026 is 15,000,000 SSV, then the program may distribute up to:

- Annual incentives cap = 15% × 15,000,000 = 2,250,000 SSV

- Monthly incentives cap = 2,250,000 ÷ 12 = 187,500 SSV

Reward Calculation

Each round, baseline rewards (Rewardsi) are calculated according to participants’ validators effective balance and tier APR boosts tiers as usual (outlined under DIP-34).

The total ![]() is compared to the monthly incentives cap:

is compared to the monthly incentives cap:

- If

: all rewards are paid out normally by the tier’s APR boost.

: all rewards are paid out normally by the tier’s APR boost. - If

: rewards are scaled down proportionally across all participants using the following adjusted formula:

: rewards are scaled down proportionally across all participants using the following adjusted formula:

![]()

Example

- Total $SSV supply at Jan 1, 2026: 15,000,000 SSV

- Annual incentives cap = 15% × 15,000,000 = 2,250,000 SSV

- Monthly incentives cap = 2,250,000 ÷ 12 = 187,500 SSV

If rewards in a given month amount to 200,000 SSV, payouts would be scaled by:

187,500 / 200,000 = 0.9375

Each validator would receive 93.75% of their baseline reward, ensuring fairness while enforcing the inflation limit.

Effectiveness of Proposed Revisions

-

Program extension and new tiers: Effective immediately upon approval.

-

Interim distribution: Due to operational constraints and the justified need for proper community feedback, if this proposal were to pass, the August distribution, scheduled for September shall be unconstrained in terms of its budget nor subject to the Inflation cap mentioned below.

-

Inflation cap enforcement: Begins with the September 2025 distribution round.

-

2025 interim cap: Until Jan 2026 distribution, monthly distributions are capped at 200,000 SSV, aligning with ~15% annualized inflation for the year.

Previous Proposals

The previous IMP proposals and terms will remain valid for aspects not amended by this proposal:

The previous IMP proposals and terms will remain valid for aspects not amended by this proposal:

- Incentivized Mainnet Program (November 6th, 2023) - Introduced the IMP.

- [DIP-18] Incentivized Mainnet Program - Revision (June 18th, 2024) (hereinafter [DIP-18]:

- duration of the IMP has been extended;

- the reward tiers were expanded to include a higher total number of validators and the respective APR boost for the new validators

- the inclusion of SAFE multisig wallets into eligible participants of the IMP.

- the distribution time of the rewards of the IMP to the 15th of the following month for the previous month at the latest.

- [DIP-22]: Incentivized Mainnet Exception for Lido SimpleDVT Participants (September 15th, 2024) (hereinafter: “[DIP-22]”)

- a new distribution contract to help with the distribution of the IMP rewards to SimpleDVT participants.

- a set of calculations to correctly track user participation and eligibility.

- a set of calculations for the payment of IMP rewards to SimpleDVT participants.

- a dedicated page for the claiming IMP rewards.

- Tying the effectiveness of the SimpleDVT program to the duration of either the end of the IMP or the Lido SimpleDVT program.

- [DIP-27] Incentivized Mainnet Program - Revision #2 (December 26th, 2024) (hereinafter: [DIP-27]):

- A more accurate way of defining when IMP rounds start and end.

- A reset of the IMP budget so that with the passing of DIP-27, the IMP budget had a total of 1 million SSV allocated for rewards.

- [DIP-30] Incentivized Mainnet Exception for Lido CSM/SDVT Participants and Updated Terms for IMP (March 31st, 2025) (hereinafter: “[DIP-30]”)

- The Lido CSM program has received an expectation of how the IMP rewards are distributed in order to facilitate a reward split between CSM participants and Lido.

- [DIP-30] also introduced a small pre-approved grant (5.000 USD) for the facilitation of the technicalities necessary to execute the new exception

- [DIP-30] allocated 930 SSV in order to fund the network fee paid by clusters to the SSV network.

- The IMP received T&Cs and a Sanction Screening policy.

- [DIP-34] Incentivized Mainnet Program - Revision #3 (May 7th, 2025) (hereinafter “[DIP-34]”)

- Due to the large expansion of TVL of the ssv.network, new tiers were introduced to support up to 200.000 validators

- The performance requirement to be eligible to receive IMP rewards has been increased from 90% to 95% of the daily Beacon Chain attestation in a given round

- Reward attribution has been changed to the address that registered the validator, regardless of whether it is an EOA or a smart contract, with two exceptions for specific addresses, and SDVT and CSM module participants.

- The Reward calculation for ETH and SSV price averages are now based on current cycle data.

- [DIP-34] introduced a dynamic fee mechanism due to the ETH Pectra upgrade, shifting the IMP calculations from a per validator model to an effective balance model. This included an adjustment to the network fee, which is still being charged per validator.