SSV community, find below the market-maker performance update.

Bitcoin breaks above $30k for the first time since June 2022. Shanghai-Capella hard fork, is set to occur Wednesday, after which users will have access to the $31 billion worth of ether (ETH) staked in the blockchain since December 2020.

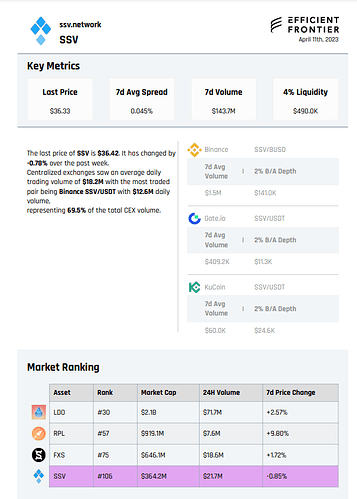

In close correlation with competitor projects, the average daily SSV trading volume has dropped by ~25% compared to the previous recorded week.

A few notes to explain what you are seeing:

• “7d Avg Spread” is the average spread from the best performing spread market (Binance USDT pair).

• “4% Liquidity” is ±2% from midprice liquidity sitting in the books across all exchanges

• In the individual pairs, the “2% Liquidity” is ±1% from the midprice liquidity sitting in that individual pair

Marketshare for the previous week:

Spreads for the previous week.

This is the % of time EF kept spreads from bid-ask at 75bps or better.

This does not include liquidity & trading in the V3 pool, as well as the hedging activity in Binance USDT pair.

Our aim is to continue to incentive volume and sustained trading health in the SSV market.